Each public sector organization goes through its own unique set of activities to forecast and set budget targets for future years. These activities are based on the specific needs of their constituents, the preferences of their elected officials, and the strategic priorities the government in question has identified.

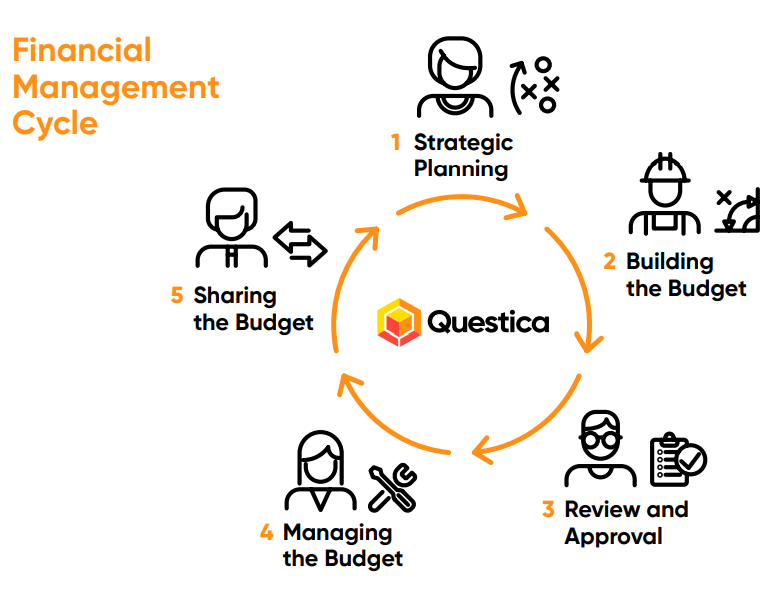

Despite all these variables, the general structure of each agency’s Financial Management Cycle is uniform and follows five major steps that are consistent across the public sector. Regardless of the focus given to different priorities over the course of this cycle, each of these five steps builds upon one another, first from one step to the next and eventually year over year.

The organizations that budget most effectively recognize this and find ways to link these steps and subsequent budgets in a meaningful way. This helps increase accuracy, efficiency, and visibility for folks inside the organization as well as the communities they support. We’ve broken down each of these steps for you, outlined their basics, and identified how some public sector organizations are driving improved efficiencies and outcomes through this cycle.

Strategic Planning

The first phase of the Financial Management Cycle is the Strategic Planning phase. During this stage, the organization’s finance team will assess a variety of inputs (last year’s budgeted and actual expenses, salary projections, inflationary considerations), and develop a baseline guidance for this period’s budget. After, they execute a high-level review of recent trends, financial targets, and potential complications and adjust their projections, annual targets, and future year targets accordingly.

Building the Budget

The finance team begins to build the budget based on the activities, assumptions, and priorities that have been identified in the strategic planning phase. They will segment that first pass into divisions, departments, and cost centers. The individual budget owners from the various departments of the organization will then see their slice of the larger budget and review what the finance team has laid out for them. The budget owners will identify any budgeted expenses that may be too high, too low, may be subject to inflation or rate increases, and update those numbers.

As the public sectors’ budgeting processes mature, these inputs from the budget owners become more detailed – justifications are provided for increased or new spends, and business cases for larger expenses may be required. This approach requires a greater focus on the permissions for individual users, since changing values in the wrong costing center or deleting a key formula can cause headaches and additional work to identify and correct the issue.

Pro Tip – To address these concerns, many public sector organizations are turning to database-driven budgeting software with built-in security permissions.

Review and Approval

Once the budget owners have made their updates and submitted any new requests, they will pass the budget along to the next phase – Review and Approval. While each organization’s process to get to an adopted budget is a little bit different, in general, it involves the different layers of management reviewing the budget at various levels of scrutiny. Once this review process has been finalized, the budget will be adopted and continue to be managed by budget owners and the finance team.

Managing the Budget

When the adopted budget is in place, the agency will continue to monitor expenses, adjust, and establish backup plans. As actual expenses are incurred, the government will want to compare them with what was budgeted to keep an eye on the difference between the two and watch for any areas where they’re overspending, or where there are available funds that could be used elsewhere.

If amendments need to be made for any reason, the finance team might collect those requests from the various budget owners or create them themselves through decision packages for the team to consider. Ideally, these are also captured within the core data set so they can be easily incorporated once approved. At any step of the budgeting process where more than one option is being considered, various “what-if” scenarios may be produced for comparison.

Typically, these are duplicated budgets with minor or major adjustments which can then be pulled into a report to assess the differences and choose a preferred option. The most efficient organizations are producing these in a way that can be easily integrated into the base budget to generate an amendment.

Sharing the Budget

Once the budget is approved or amended, it’s important to share this information with internal and external stakeholders. Most public sector organizations produce a budget book to share with their council and public constituents. Although the budget book usually compiles the narrative and numbers for the upcoming budget year, for both the operating and ongoing capital budgets, these can be as simple as a series of exported reports or as polished as a GFOA Award-winning book.

Regardless of how the information is being presented, the trend among agencies is towards an integrated process for exporting this information. It can be very time-consuming to convert financial information into a usable format for the public, and any time that can be saved by automating this conversion can be redirected towards the strategic analysis and decision making that will make a greater impact on the community.

Conclusion

While it is important to think of all aspects of the Financial Management cycle as individual parts, each step should receive equal attention in order to be running properly or the result can be inefficient or inaccurate. But how do public sector organizations put together a plan to address these issues? We have some suggestions.

- First, you can break out your process into the five steps above. For each step, identify things like systems in place, contributing team members, and overall steps to the process.

- Next, identify gaps or goals for each step of the process. You can start by ranking each step on a scale from 1 to 10, then calling out specific areas that, if addressed, could bring you closer to a 10/10.

- Once you’ve identified the areas you’d like to improve, you can call out the highest priority actions (typically ones that will drive the greatest impact) and low-hanging fruit that can be incorporated into the process with minimal effort. From here, you just need to determine how best to tackle the goals you’ve laid out.

Learn how Questica Budget can simplify your budgeting process and enhance your organization’s Financial Management Cycle – Download Whitepaper